dependent care fsa limit 2022

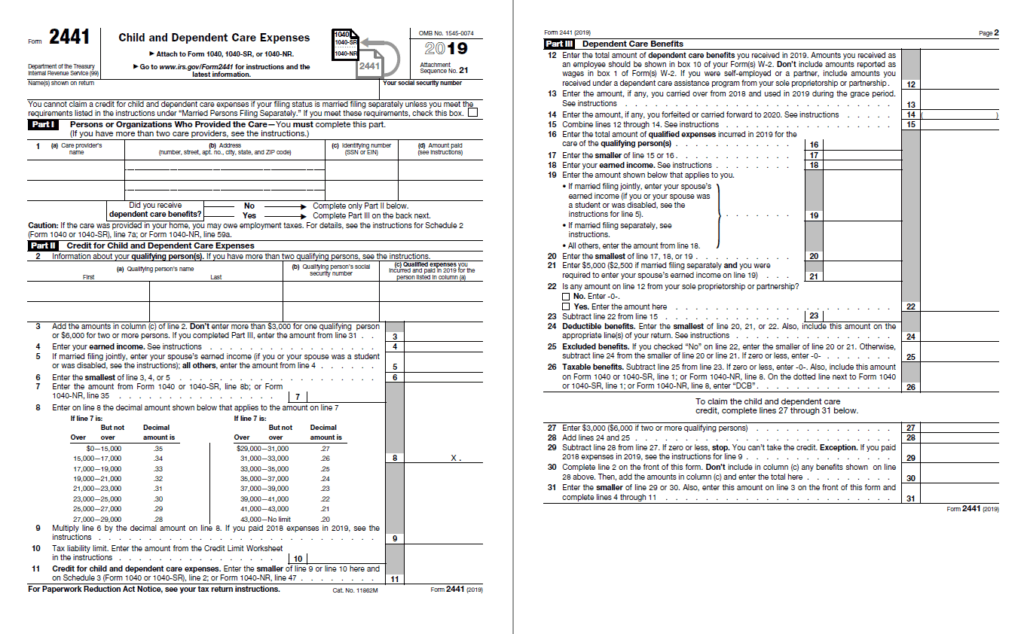

You cannot change your contributions during. A health care FSA only reimburses employees for money spent on medical care as defined under Section 213d of the Tax Code.

Irs Releases Fsa Contribution Limits For 2022 Primepay

The most money in 2021 you can stash inside of a dependent-care FSA is 10500.

. IR-2021-105 May 10 2021 WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. A TexFlex dependent care flexible spending account FSA lets you set aside money on a pre-tax basis for. The hcfsalexhcfsa carryover limit is.

The maximum amount you can put into your dependent care fsa for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. For 2022 the exclusion for DC FSA benefits under Code Sec.

Limits for each year. Section 213d of. Maximum Annual Dependent Care FSA Contribution Limits If your tax filing status is Married.

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. A flexible spending account FSA is an account in an employees name that reimburses the employee for qualified health care or dependent care expenses. Therefore highly compensated employees pre-tax DCFSA contributions will be capped at 2600 for the 2022 plan year.

Employers may allow participants to carry over unused amounts IR-2021-40 February 18 2021 WASHINGTON The Internal Revenue Service today provided greater flexibility due to the pandemic to employee benefit plans offering health flexible spending arrangements FSAs or dependent care assistance programs. It remains at 5000 per household or 2500 if married filing separately. If you are divorced only the custodial parent may use a dependent-care FSA.

Its a smart simple way to save money while taking care of your loved ones so that you can continue to work. Dcfsa elections for 2022 will be subject to the. The employee incurs 5500 in dependent care expenses during the period from January 1 2022 through June 30 2022 and is reimbursed 5500 by the DC FSA.

The limit will return to 5000 for 2022. 2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc Big Changes To The Child And Dependent Care Tax Credits Fsas. 2022 and November 15 2023.

The guidance also illustrates the interaction of this standard with the one-year increase in. The employee contributes 5000 for DC FSA benefits for the plan year beginning July 1 2022. The American Rescue Plan Act and IRS Notice 2021-26 allowed employers to increase the limit of the dependent care flexible spending account DCFSA.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. However due to COVID-19 the age limit was bumped to age 14 in 2021 for any unused 2020 money. On November 10 2021 the IRS announced the maximum 2022 contribution limits for health care flexible spending accounts FSAs and limited purpose FSAs commuter benefits and adoption assistance.

For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. For 2022 it remains 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately.

The limit for dependent care flexible spending accounts has been stuck at 5000 since the accounts inception in the 1980s. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. 10 as the annual contribution limit rises to 2850 up from.

For the 2021 taxable year only Congress increased the maximum exclusion limit for employer-provided dependent care assistance programs from 5000 to 10500 5250 for. The carryover limit is an increase of 20 from the 2021 limit 550. As set by the internal revenue code the dependent care fsa limits for 2022 are 5000 for married filing jointly or single and 2500 for married filing separately.

After that youll forfeit any remaining funds. You may contribute the minimum of 180 or up to the maximum of 5000 for the plan. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700.

The dependent care fsa annual maximum plan contribution limit is 2500 for those married and filing separately and 5000 for those single or married filing jointly. To be clear married couples have a combined 5000 limit even if each has access to a separate dependent care FSA through his or her employer. As A Result The Irs Has Revised Contribution Limits For 2022.

5000 per year per family if your 2020 earnings were less than 130000. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. The Savings Power of This FSA A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycare.

You are classified as a highly compensated employee as defined by the IRS if your total compensation is equal to or exceeds 130000. For 2022 the contribution limit is 2850. This is an increase of 100 from the 2021 contribution limits.

The 2022 Dependent Care FSA contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately. The 2022 limits as compared to the 2021 limits are outlined below. The health care standard or limited fsa rollover maximum limit will increase from 550 to 570 for plan years beginning on or after january 1 2022.

Filing jointly your annual limit is. Dependent Care Fsa Limit 2022. Filing separately your annual limit is 2500 per each spouse.

The 2021 Dependent Care FSA limits came in response to the COVID-19 pandemic as a temporary relief to working parents.

Dependent Care Benefits Overview Criteria Types

Payroll Tax Rates And Contribution Limits For 2022

Irs Releases Fsa Contribution Limits For 2022 Primepay

How Does A Dependent Care Fsa Dcfsa Work Lively

Claiming The Dependent Care Tax Credit For 2015 Kiplinger

Dependent Daycare Eligible Expenses Chard Snyder

The 2022 Fsa Contribution Limits Are Here

Dependent Care Fsa Union Bank Trust

/flexible-spending-account-fsa-written-on-a-wooden-cubes--1070418618-74ab17cbd81e44fdbd5cf019a02c2593.jpg)

Flexible Spending Account Fsa Definition

A List Of 77 Hsa Eligible Expenses For 2022 Goodrx

Hsa 2022 Contribution Limits Bri Benefit Resource

When Can I Make An Election Change To My Fsa To My Hsa Bri Benefit Resource

Dependent Care Fsa Union Bank Trust

What The New 401 K Fsa Contribution Limits For 2022 Mean For Hr Hr Executive