child tax credit payment schedule irs

Each payment will be up to 300 for each qualifying child under the age of 6 and up to 250 for each qualifying child from ages 6-17. 1200 in April 2020 600 in December 2020January 2021.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

More than 9 million individuals and families could be leaving money on the table by not filing a 2021 federal tax return according to the IRS.

. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. How to Claim This Credit. In 2021 a full 3600 child tax credit was available to couples making less than 15000 or 75000 for singles.

Future payments are scheduled for November 15 and December 15. Here are the official dates. Previously most taxpayers could save up to 2000 per child on their federal income tax payment.

The Internal Revenue Service is keeping its Free File program open an extra month which extends the time for eligible people to claim COVID stimulus payments including the. Here Are The Dates The Child Tax Credit Payments Should Hit Your Bank Accounts July 15 August 13 September 15 October 15 November 15 December 15 In case you are. Individual Income Tax Return and attaching a completed.

Families may earn a 3000 tax credit for each kid aged six to seventeen under. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. So if a child turns 18.

An audit revealed that the Internal Revenue Service delivered more than 1billion in child tax credit payments to millions of Americans who werent entitled to the free money. My submitted 8812 to the IRS showed 4000 in Child Tax Credit. If you filed a paper return it can take up to four weeks after it is mailed.

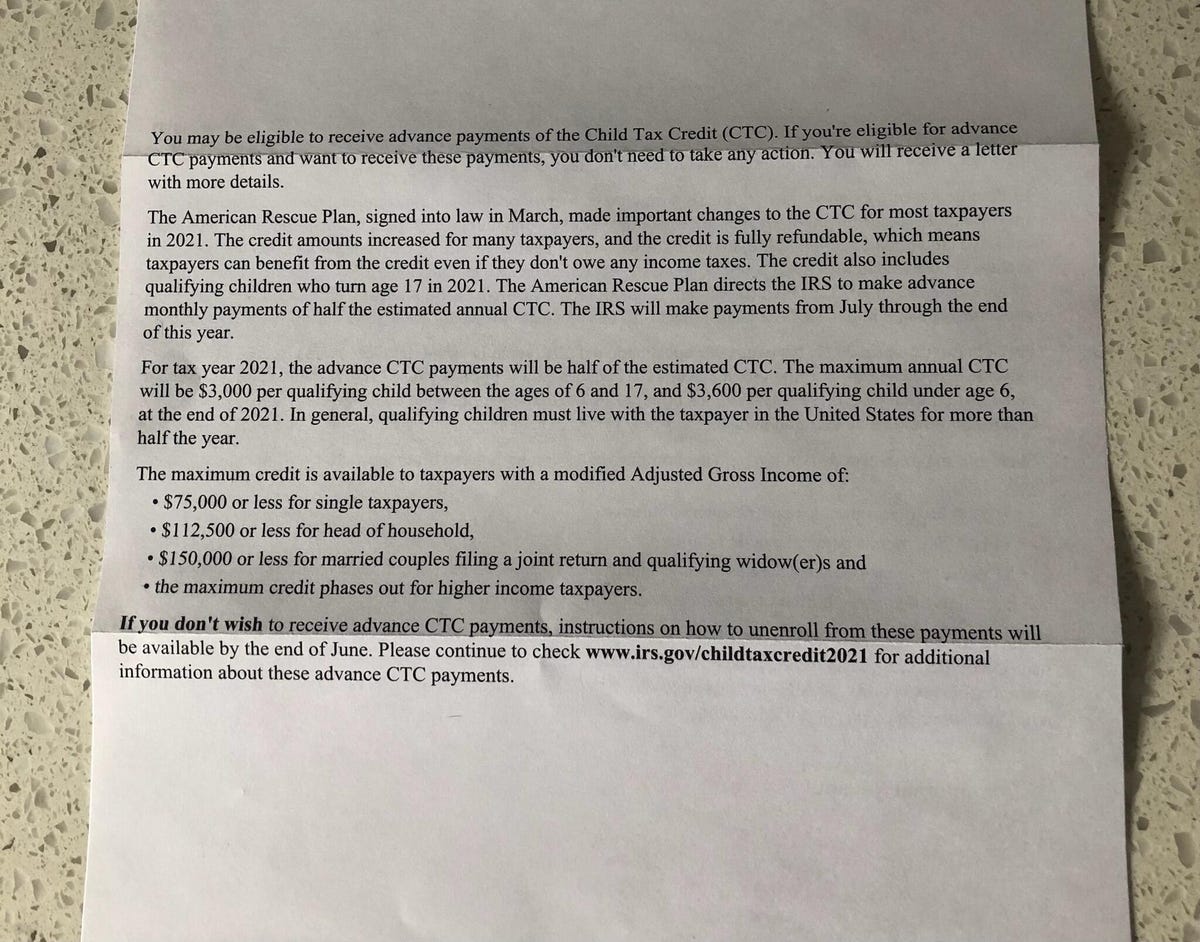

Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. How Next Years Credit Could Be Different For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600. Other amounts and phaseout income.

For these families each payment is up to 300 per month for each child under age 6 and up to 250 per. Last week the federal tax agency. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US.

Child Tax Credit 2022. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. The IRS will pay 3600 per child to parents of.

Tue Oct 18 2022 LOGIN Subscribe for. It is in addition to the credit for child and. Child tax credit payments will revert to 2000 this year.

15 The payments will be made either by direct deposit or by paper check depending on what. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per. The deadline for this money is also fast approaching people who qualify have to file their information by.

Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. Half will come as six monthly payments and half as a 2021 tax credit. Millions of families received up to 300 per child in monthly.

The IRS saidt it is sending out reminder letters to those who may be eligible to claim some or all of the Child Tax Credit and other payments. The IRS began sending advance monthly payments to parents and guardians in July 2021 Nearly 90 percent of advanced Child Tax Credit payments were paid through direct deposit. The status of your refund will be available within 24 hours after the IRS accepts your e-filed tax return.

On Thursday the IRS said it will send letters to more than 9 million families who are potentially eligible for benefits including stimulus payments or Child Tax Credits but didnt.

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Irs August Child Tax Credit Payment On The Way Kxl

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

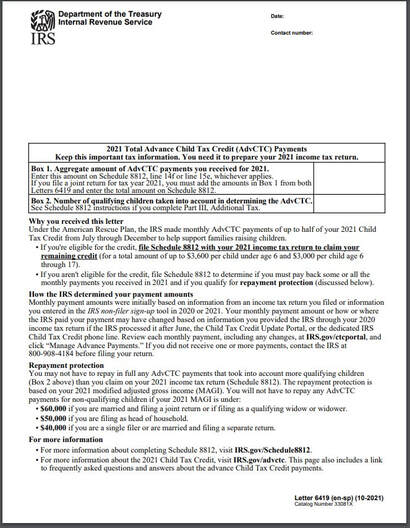

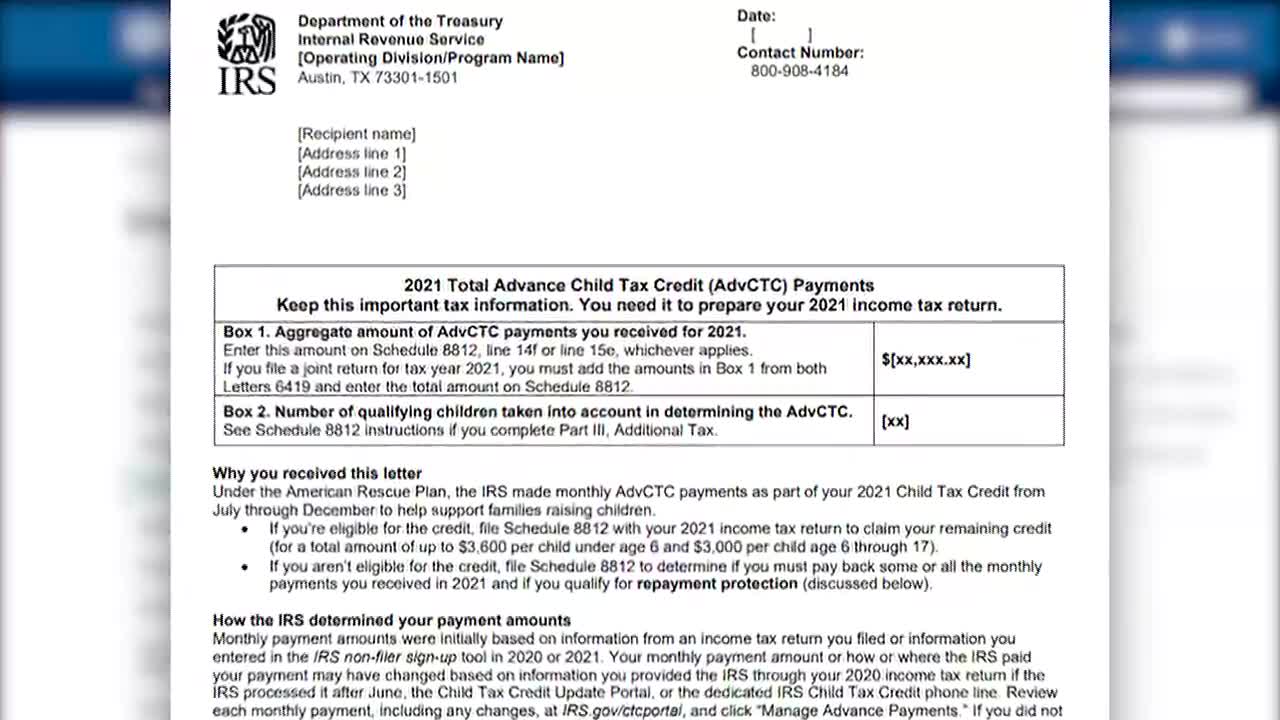

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Child Tax Credit Payment Schedule For 2021 Kiplinger

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Adv Child Tax Credit Cwa Tax Professionals

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Payments What S Next

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Irs Sending Letters To Advance Child Tax Credit Recipients

August Child Tax Credit Payments Issued By Irs Why Yours Might Be Delayed

Child Tax Credit What We Do Community Advocates

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022